Chasing Geographic Patterns through M&A can be a Fool’s Errand

Recent reporting by Law360, backed by Leopard Solutions’ data, indicates Big Law has been pouring into secondary markets over the past year. The reasons are multifold. Some use it to retain talent that swore off big cities after COVID. In contrast, others are drawn to the lower overhead and opportunities to offer more competitive billing rates. Whatever the reason, it is accomplished in many instances through acquisition, merger, and recruitment of entire swaths of attorney groups.

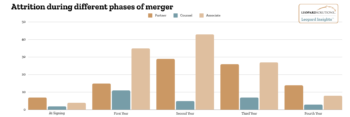

Leopard Solutions State of the Industry report revealed that 2023 was a year of mergers, with a giant one still looming in 2024. It was a primary means for firms to pursue fast growth. Our merger tool captured 44 last year out of the firms we track. While the big firms tend to suck up most of the media oxygen, numerous small firms make incremental grains through combinations. Our scorecard displays the results of these unions, with a careful watch over attrition.

Our merger and acquisition tool attributes a success rate to all M&A activity encountered by looking at the target firm and seeing how many of those attorneys stay for four years after the merger. If less than four years old, then it is the percentage of those who have left so far with the expectation that we are still watching it. What we have witnessed over time is that the majority pan out differently than intended. Not all are folly, but an unsuccessful pairing can irreparably harm a firm. Conversely, non-integration can also tarnish a firm, evidenced by the downfall of Strook, where conjecture about their failed attempts and all that implied had the partnership making a beeline to the exits.

Looking back four years, to gain sufficient historical perspective, we saw some high-profile firm marriages falter with paltry, or in some cases, negative, growth decline percentages when monitoring the attorneys moved at signing. Troutman Sanders LLP and Pepper Hamilton are prime examples; to date, they have only retained 56% of the 459 attorneys they took on in the succeeding span. Lathrop GPM LLP and Gray Plant and Moody have not fared much better, keeping only 58% of the attorneys coming over from the target firm, excluding those left at signing. A final case study: the merger of Faegre and Drinker Biddle & Reath LLP saw 40% of their combined 1262 headcount dissipate over time.

Chasing trends into perceived “hot” markets can be a short-term means to accelerate growth, but it can also be shortsighted. Without meticulous attention paid to culture fit, redundancies, and inherited commitments, a “quick fix” can spell doom for a firm.

Posted on