Firm Hiring Self-Corrects

Leopard Solutions’ proprietary law firm growth and decline data contradicts a recent Thomson Reuters Institute study. Thomson Reuters Institute Law Firm Financial Index (LFFI) found that law firms were looking to slash expenses of first-year hires in 2023, but that the decline in hiring was localized to new associates. Pointing to “a brisk lateral market, particularly at midsize and Am Law 200 firms,” as evidence that the “industrywide slowdown in new associate hiring hasn’t been enough to offset other headcount growth among midsize and Am Law 200 firms.” Yes, hiring first-years is indeed on a downswing, but the numbers tell us so, too, is lateral hiring. This is despite a reversal in hiring practices we have seen unfolding over a five-year span where firms have been favoring the lateral market to populate their ranks.

Context is King

Jan – Sept

2021- NEW – 4432, LAT 7860

2022 -NEW – 3684, LAT 7983

2023 – NEW – 2591, LAT 5264

–*NEW – first-year hirings, LAT – Lateral hiring

As depicted in the chart above, the decreases come after two years of unrestrained hiring. and when analyzed over time, it should be perceived as a market correction rather than a wholesale strategic pivot. Some firms laid off in droves following the post-pandemic splurge, leading all hiring to cool.

More Precipitous than Conceived

Our data also diverges from the LFFI report in terms of scope- the LFFI average number of new first-year associates at Am Law 100 firms was down 17% this past September as compared with the average from the previous two years. Leopard Solutions calculated the same metric at 36%, more than double that percentage (Average of 2021/2022 new hires 4,058/2023 New = 2591). Similarly, we also found a decrease in lateral hiring for the same demographic which was 34% (7921/2023 LAT = 5264). The LFFI listed first-year class sizes as having fallen in size by an average of 25% among the Am Law 200 firms, whereas our percentage was slightly higher at 28%.

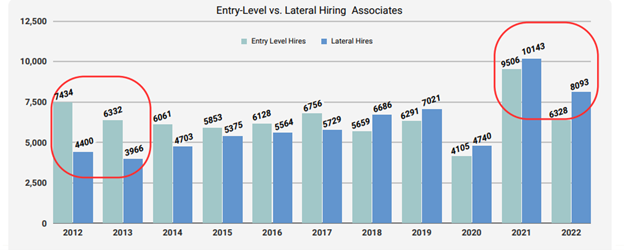

A Marked Shift in Strategy

It is evident that the decline in entry-level hiring has been occurring over the years in favor of a shift to hiring laterals. Big Law once hired twice as many law graduates as laterals, but in 2018, that paradigm flipped. only 55 firms in this group hired more entry-level associates than lateral associates. This trend of championing a lateral market that commands higher and higher salaries may also be the reason Reuters reported overall law firm direct expenses were up more than 6% in the third quarter of 2023, as opposed to solely attributing the expenses to the increase to headcount growth.

Long-term Consequences

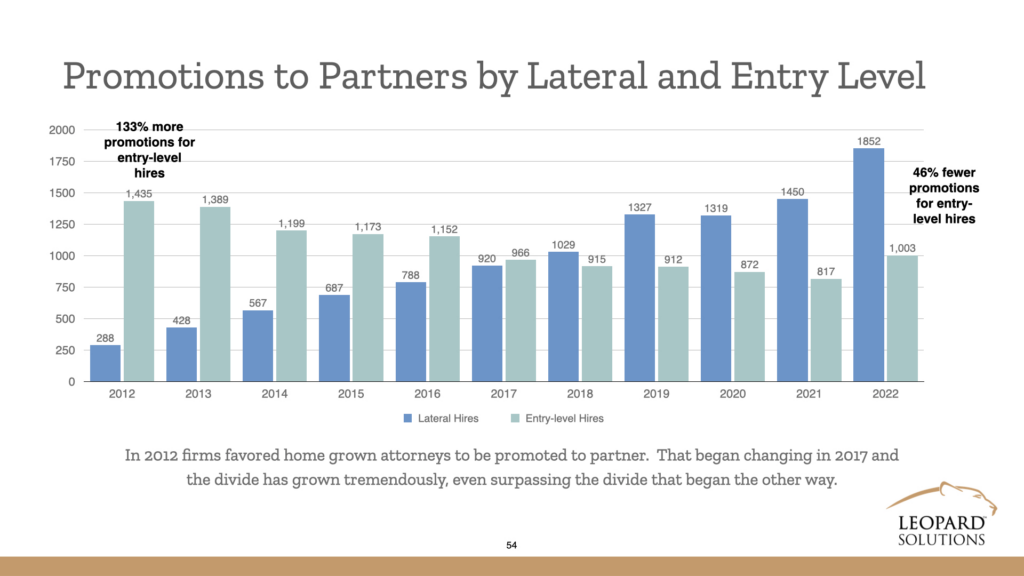

The calculus is simple: recruiting already successful attorneys brings with it transferable business, proven high-fee earners, and an established book of business. Lateral hiring may scratch an itch; however, this new hiring strategy puts firms at risk down the road. Firms must contend with the question of who will train new associates. In the long term, they cannot depend on lateral hiring alone. They are also promoting entry-level hires are a lower level than in the past. It could be due to their fewer numbers but not totally.

Posted on