The Leopard Law Firm Index (LLFI) 2023 Leaderboard Shuffle

The Leopard Law Firm Index (LLFI), the legal industry’s only dynamic measuring stick of holistic law firm health and prestige, has gone to press with its 2023 ranking. The ranking is derived from a firm’s average LLFI score throughout the calendar year, accounting for many micro and macroeconomic factors and a firm’s accompanying resilience or lack thereof. Unlike other firm-reported rankings, the Leopard Index is wholly ungameable. The data is entirely compiled from public attorney records and is not overly reliant on any one metric, particularly finances, which are easily massaged in concert with headcount reporting. We evaluate firms across key performance indicators, including growth/decline, retained experience, promotion, RPL score, ROI on lateral hiring, new hires, and ethnic and gender diversity. Each pillar is weighted correspondingly to a firm’s size to remove bias. You can find details on the full methodology here.

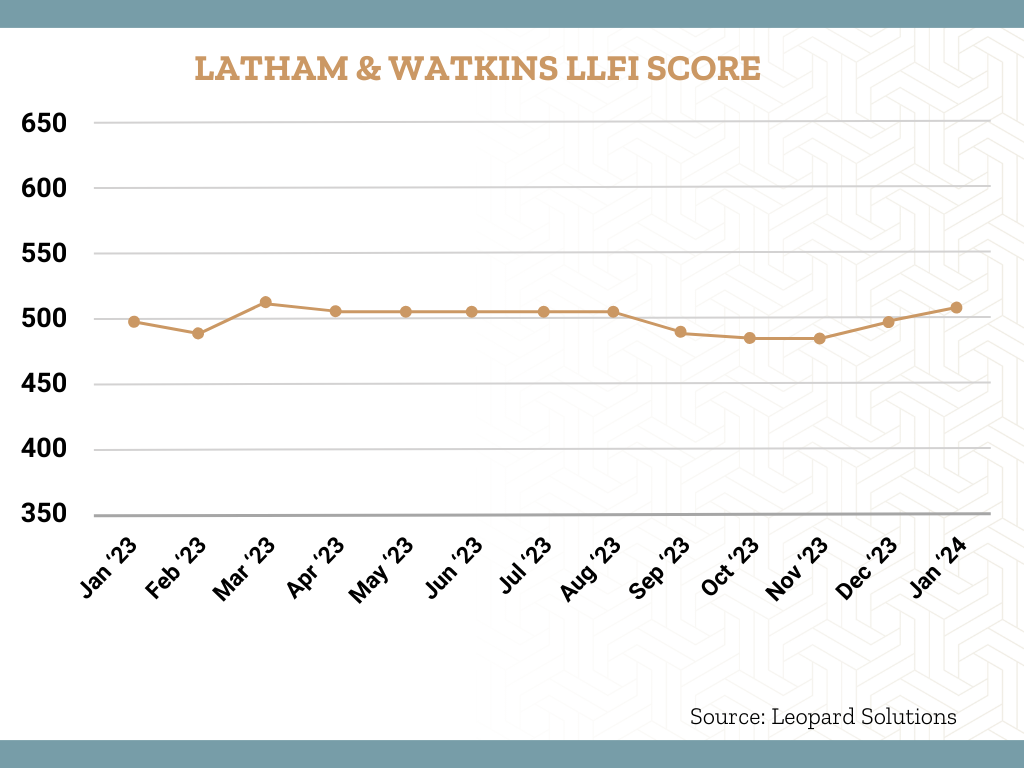

The 2023 ranking saw Latham & Watkins dethrone Kirkland & Ellis as the reigning number one. The powerhouse global firm had a banner year, maintaining a perfect 500 score for seven months, including an impressive consecutive stretch from March through August.

Jones Day Strategic Hiring and Retention Staves Off Competition

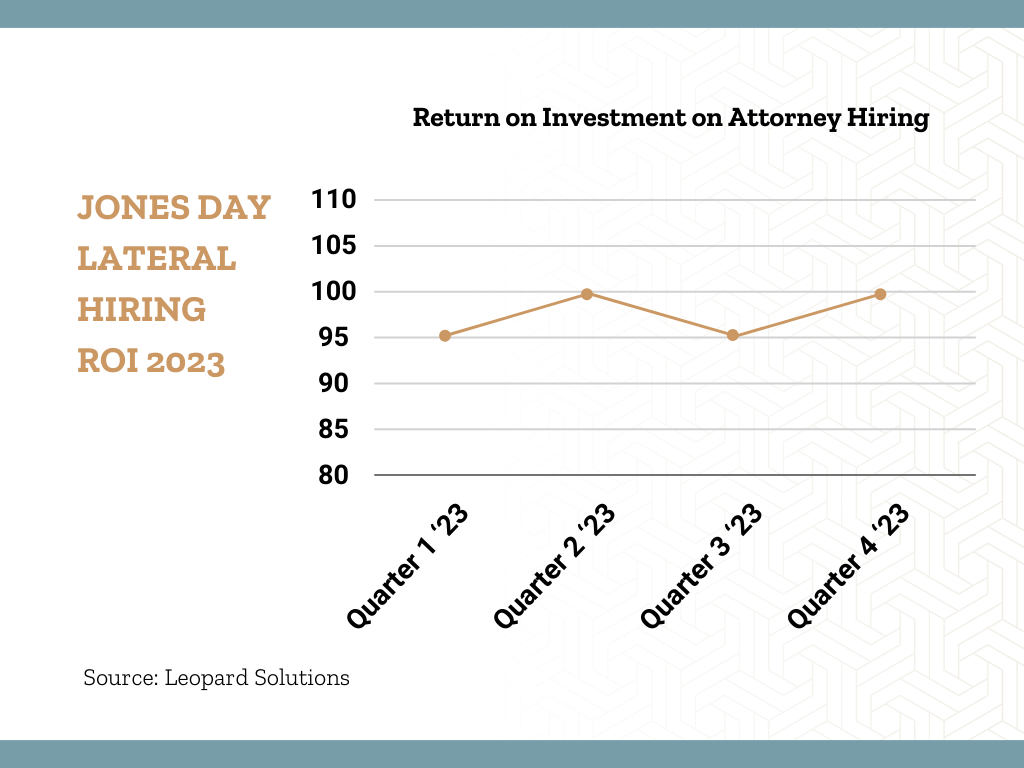

In 2023 the Top 20 LLFI firms also featured six new entrants, including Skadden, Jones Day, WilmerHale, Orrick, Ogletree Deakins, McDermott Will & Emory, and Littler Mendelson. Among these, Jones Day experienced the most significant year-over-year turnaround. They climbed a whopping 158 spots to slide into 11th place overall. Not surprisingly, they also led the way for the most significant ascension in average score, rising 93 points, 31 more than number two Proskauer Rose. One of the contributors to the strong year for Jones Day was their clear prioritization of hiring and staving off attrition. 2023 saw Jones Day hire 67 associate laterals and 156 entry-level hires. As seen in the chart below, most of these were converted into successful returns on investment. This saved the firm countless dollars in recruitment and kept the machine well-oiled. The ongoing commitment to developing and promoting internally was again on display when they announced 51 promotions to partners to begin the new year (2024).

Non-AmLaw Firms Have Strong Showing on LLFI

As for Proskauer, from January 1 to 11, 2023, they lost 80 attorneys and only hired 44 to replace them. Their growth decline was at -5 %, but by the end of the year, they had lost 93 attorneys and picked up 91, taking it to 2%. It was a quick turnaround bolstered by them hiring 34 associates and 12 partner laterals from November through December. They also brought on 42 entry-level hires for the entire year to reach that significant number.

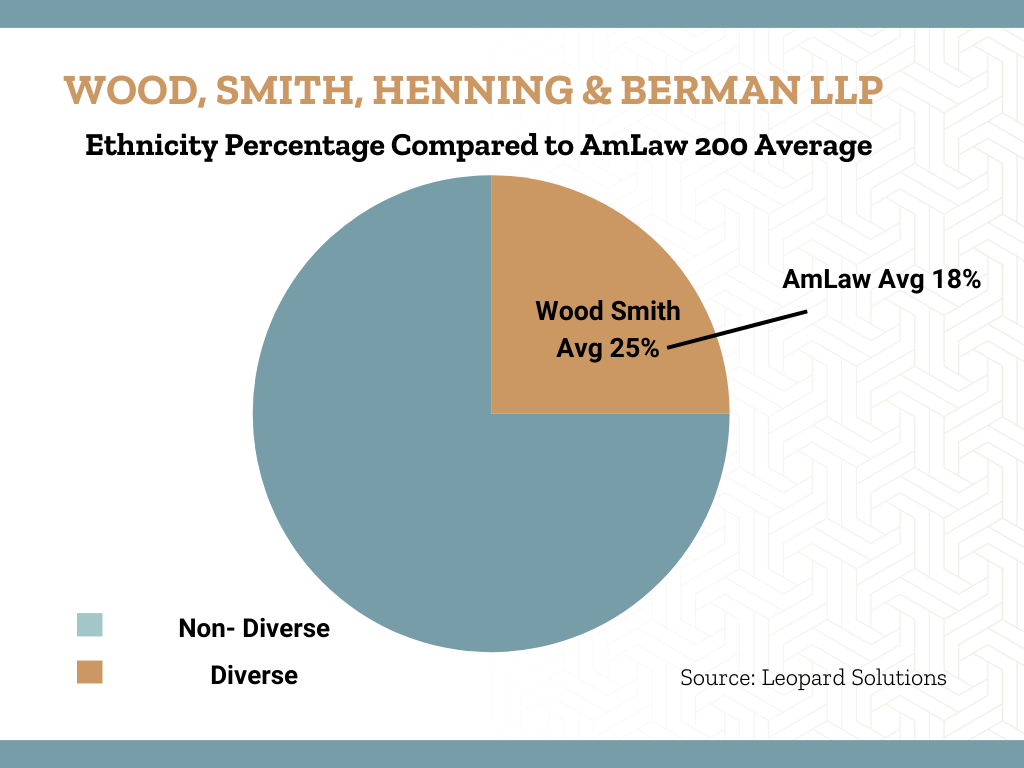

This year’s ranking of 200 featured 40 firms (20% or 1 in 5) non-Am Law 200 firms. Some of that is attributable to international qualification constraints, but it also speaks to how firm vitality transcends gross revenue and is based on myriad factors. One such firm that thrived under the radar was Wood Smith Henning Berman, a 430-attorney Litigation shop based in Los Angeles that finished in the LLFI top 100 (85). They excelled in diversity hiring, as illustrated by this chart highlighting their ethnic diversity with high low probability. They bested the Am Law 200 average by seven percentage points.

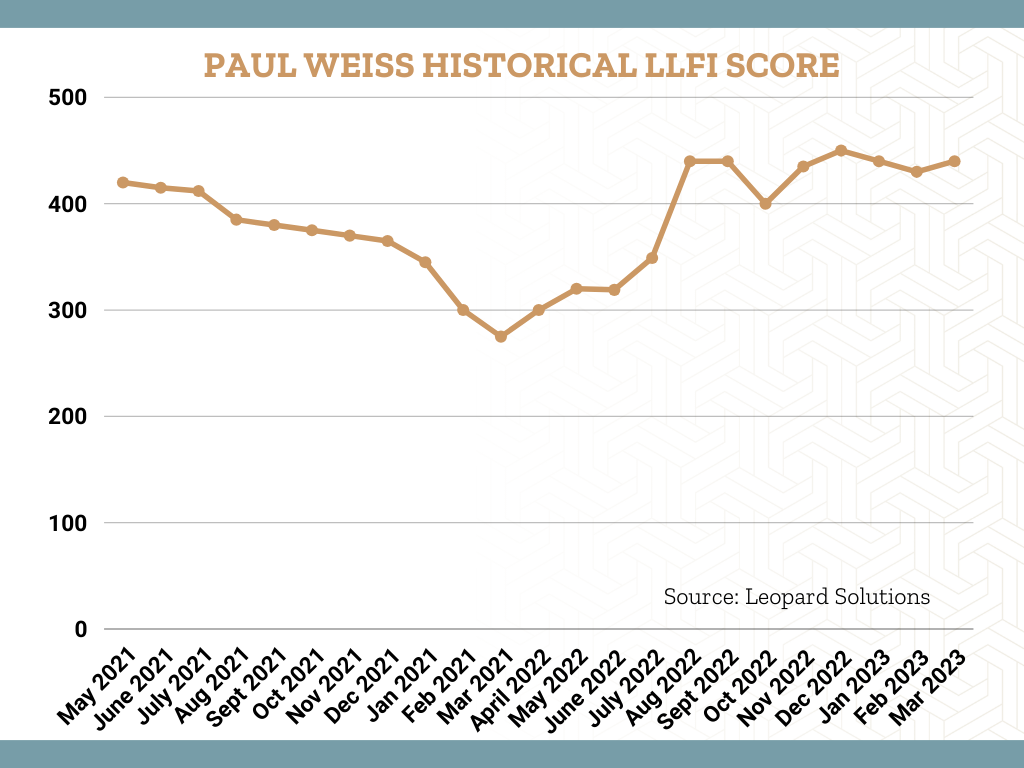

Other interesting outliers included Ogletree Deakins, which made the LLFI top 20 despite being 77 in the Am Law ranking by gross revenue. They did so by continuing to dominate the Labor and employment space where over a thousand of their attorneys are concentrated in this practice area. Paul Weiss was another firm that enjoyed a sparkling 2023. Emerging from a lackluster 2022, they failed to crack the LLFI 200 with a score cratered to 275 in March of 2022 (closed out the year with an average of 346). In context, Paul Weiss declined by 10% in the 12 months before 3/31/2022, the worst decline in the AmLaw 50. In general, AmLaw 50 grew by 6% during that time, and only seven firms experienced a decline.

In contrast, they have grown by 12% in 2023, the top 3 growth in AmLaw 50. AmLaw 50 average growth in 2023 was 1%. Our data shows that in 2022, Paul Weiss’s ROI was in the bottom 10% of the AmLaw50, and in 2023, it was in the top 6%. The big swings in growth and retention numbers between 2022 and 2023 explained how they climbed into the LLFI 200.

Since 2020, the Leopard Law Firm Index has provided legal leaders invaluable tools for measuring law firm Growth and stability. All the law firms Leopard Solutions tracks, currently over 5,300, are listed on the Leopard Law Firm Index. Leopard Solutions customers can access and run the firm index report through the Leopard BI (Business Intelligence) platform for more in-depth analysis and comparison of the firm rankings. The complete list of the 2022 top 200 firms is available here.

Attend the upcoming Leopard Solutions webinar to find out which firms made the 2023 leaderboard and as the presentation will go beyond the rankings, offering an in-depth exploration of the compelling stories, innovative strategies, and successes of the firms that have earned a place on the leaderboard.

Posted on