Q4 2025 sends a clear message: law firm hiring isn’t stopping, it’s getting smarter.

Hiring levels held steady relative to Q3 2025, with openings and closures tracking closely. This shows firms are sticking to plan rather than rushing to expand or pulling back.

Year over year, law firm job postings increased, with December telling the strongest story. Compared to December 2024, job openings jumped 41%, and closures rose 22%, showing firms’ willingness to invest in talent before the calendar turned.

Instead of broad expansion, firms are opening targeted roles, letting positions remain open longer, and prioritizing fit and specialization over speed. Growth continues to concentrate in areas such as Real Estate and Artificial Intelligence (AI), where firms see sustained, long-term demand.

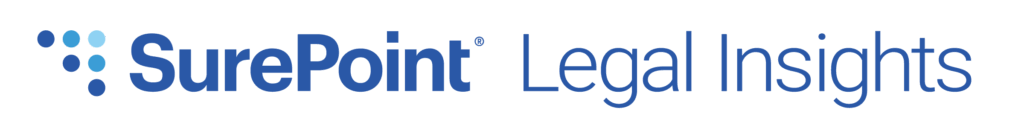

ALL FIRMS

Across a consistent subset of tracked firms, 3,402 new positions were posted in Q4 2025, nearly matching Q3 2025 (3,406). During the same time, 3,273 roles were filled, keeping hiring balanced and controlled.

Year over year, the market showed clear forward momentum. Compared to Q4 2024, job postings increased 12% and closures rose 8%, pointing to a healthier and more intentional market. That momentum became most visible in December with 1,094 new job postings and 1,100 closures—a notable increase from the 774 postings and 900 closures in 2024, reflecting a sharper year-end push rather than a seasonal slowdown.

By the end of the year, firms carried 6,899 total open roles, up from 6,366 at the close of 2024. While demand grew, it did so at a more measured pace, suggesting firms are comfortable keeping roles open as they search for the right talent rather than filling positions quickly.

Two trends stood out:

- Real Estate job postings increased 20% year over year in Q4 2025, while December postings were up 34%.

- Demand for attorneys with AI specialization surged. Q4 new job postings rose 182% year over year, and closures increased by 264%. Compared to Q3 2025, postings were up 40% and closures 37%. December saw an evenbigger jump, with postings up 150% and closures up 400% year over year.

Worth noting: Since AI was added as a tracked specialty to the SurePoint Legal Insights platform in June 2024, the number of AI attorneys in the database has grown 62%.

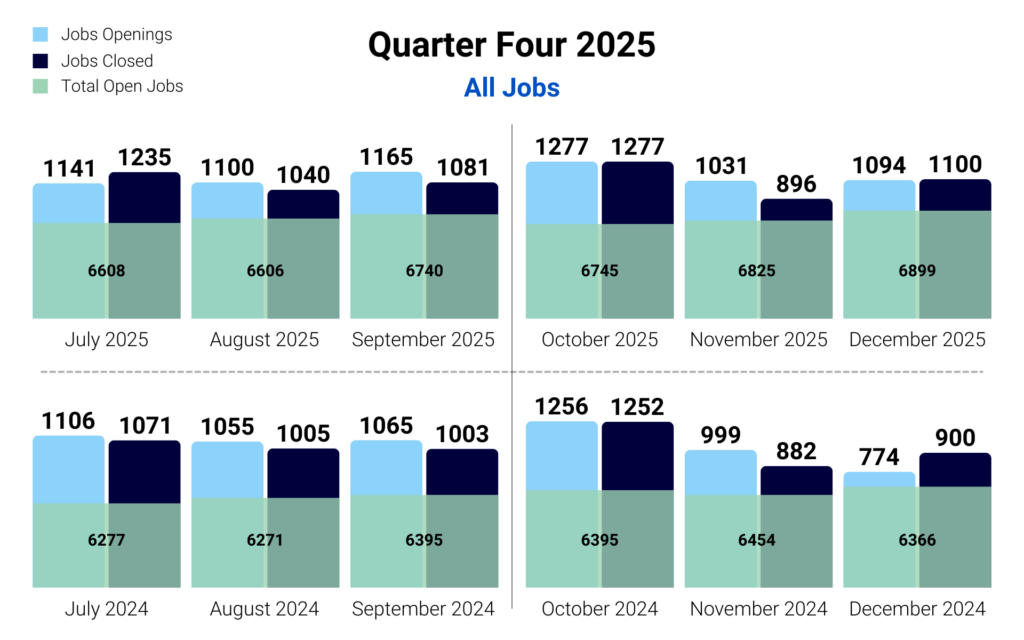

U.S. FIRMS

In Q4 2025, U.S.-based firms posted 2,639 new positions and filled 2,510 roles, maintaining close alignment between demand and execution.

That consistency carried over from Q3 2025, when firms posted 2,614 openings and filled 2,615 roles, reinforcing a steady hiring pace.

Year over year, momentum continued to build. Compared to Q4 2024, job postings increased 13% (+306) and closures rose 10% (+237). The most meaningful shift came in December, when new job openings rose 44% and closures increased 20% compared to December 2024.

By the end of December 2025, U.S. firms reported 5,901 open roles, up from 5,444 a year earlier.

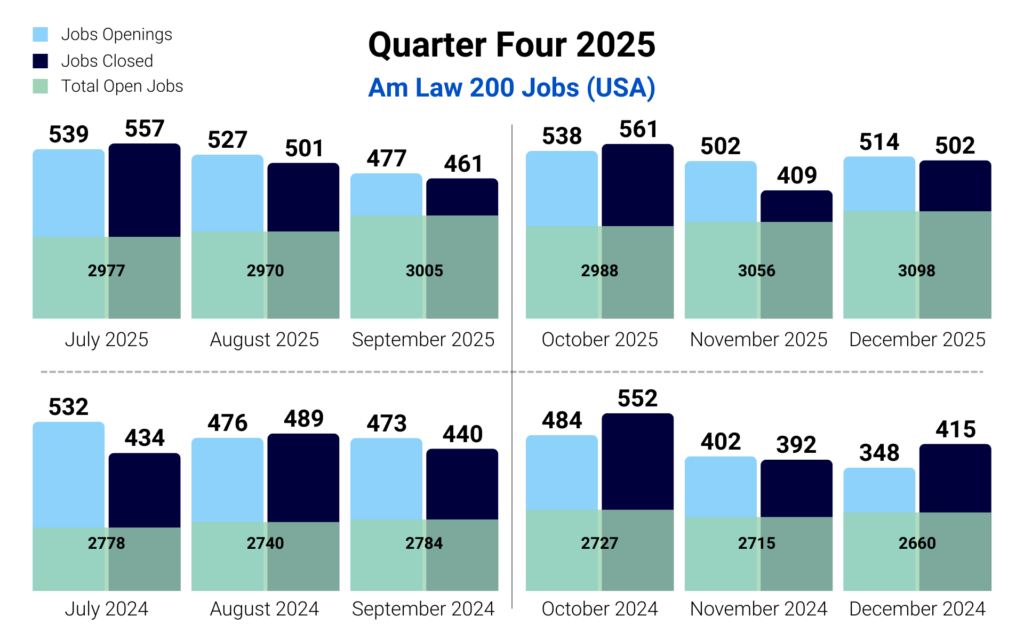

AM LAW 200 FIRMS

Am Law 200 firms continued to hire with precision, particularly those based in the U.S.

In Q4 2025, U.S.-based Am Law 200 firms posted 1,554 new positions—a 26% increase compared to the same time last year—while closures rose a more modest 8%.

December activity stood out once again. New postings jumped nearly 48% compared to December 2024, while firms filled 21% more roles. Instead of slowing down for the holidays, U.S.-based Am Law 200 firms stayed active, signaling confidence heading into 2026.

By year’s end, total open roles reached 3,098, up from 2,660 a year earlier, showing continued demand for top talent.

Bottom Line & What to Expect Next

Q4 2025 reflects a hiring market that is steady, disciplined, and increasingly targeted.

Firms are hiring, but they are being selective. Openings and closures remain closely aligned; growth is gradual, and hiring is increasingly tied to specific areas of specialization.

Looking ahead to 2026, demand for experienced and specialized talent is expected to remain strong. However, the data suggests firms will continue to prioritize strategic hires supported by accurate market intelligence.

In short, the market is strong—and getting stronger.

Methodology Note:

This analysis is based on a consistent cohort of 1,100+ firms tracked over time in the SurePoint Legal Insights platform to ensure trends reflect true market movement rather than database growth.

For more insights into legal job trends, hiring activity, or lateral hiring patterns, contact us or learn more here.