U.S. Law Firms Filling Roles Faster, Lateral Moves Surge, and Top Talent Remains in High Demand

Hiring isn’t slowing; it’s sharpening.

The legal job market in Q3 2025 remained steady, but hiring is more targeted. Firms are filling roles faster, lateral moves are increasing, and top-tier firms are carefully managing their headcount.

On a year-over-year basis, Am Law 200 firms surged to an 8% increase in total open roles (+236), outpacing the broader market, signaling that top talent remains in high demand despite economic uncertainty.

Quarter-over-quarter changes were moderate in the broader market, with openings rising by 3% and closures by 2%, resulting in a slight rise in total roles (+21). Overall, firms are moving decisively, creating roles and filling them quickly.

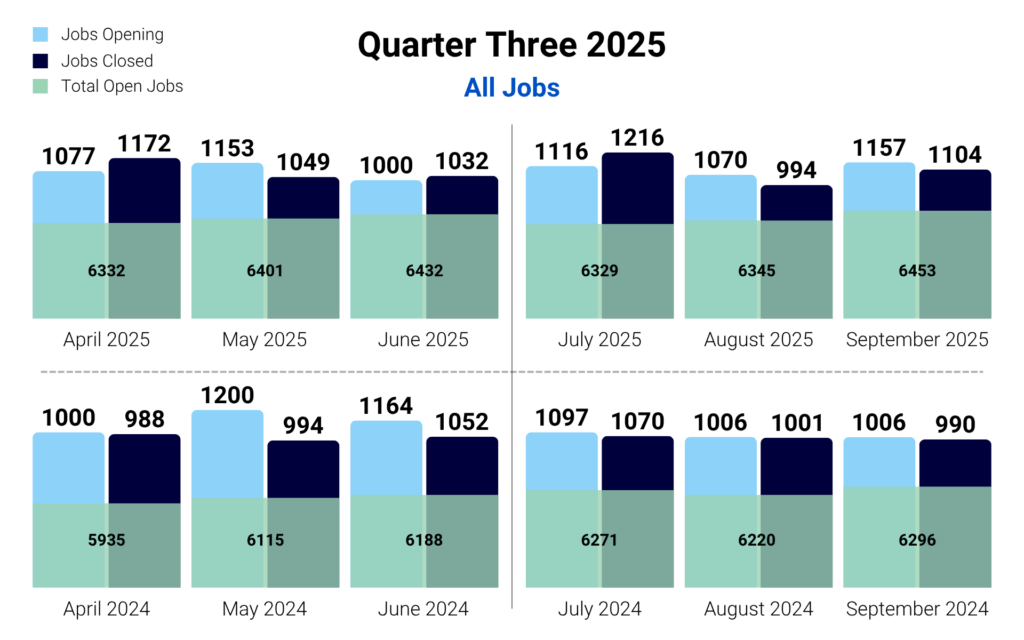

All Firms: Steady Momentum

The overall market is moving with purpose. Among a consistent subset of tracked firms, Q3 2025 recorded 3,343 new openings and 3,314 closures, leaving 6,453 total open roles, a 2% year-over-year increase.

Closures nearly matched openings, showing that firms are expanding carefully. Compared to the same period last year, both role openings and closures rose 8%, indicating steady yet selective growth.

Compared to:

- Q3 2024: 3,109 new job openings | 3,061 jobs closed

- Q2 2025: 3,230 new job openings | 3,253 jobs closed

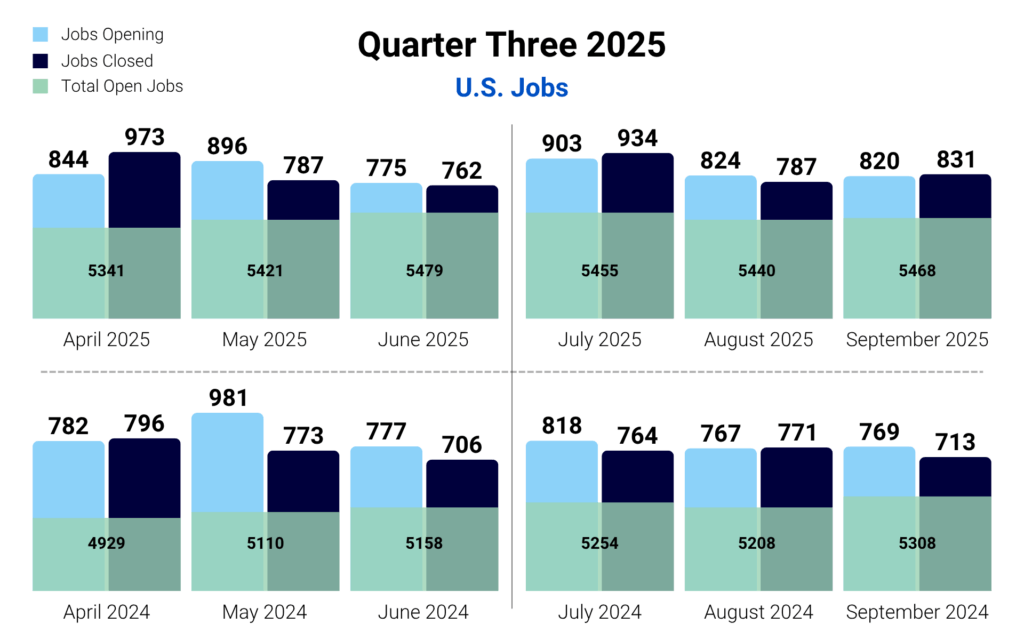

U.S. Firms: Measured, Disciplined Demand

U.S.-based firms are hiring with intent. In Q3 2025, they posted 2,547 new openings and closed 2,552 positions, bringing the total number of open roles to 5,468—up 8% in new postings, a 14% rise in closures, and a 3% growth in total open jobs from Q3 2024.

The faster rise in closures shows decisive and selective hiring.

Quarter-over-quarter, the U.S. market remained steady: only 32 more openings and 30 more closures than Q2 2025. Hiring continues at a steady rate as firms plan strategically for year-end and the start of 2026.

Compared to:

- Q3 2024: 2,354 new job openings | 2,248 jobs closed

- Q2 2025: 2,515 new job openings | 2,522 jobs closed

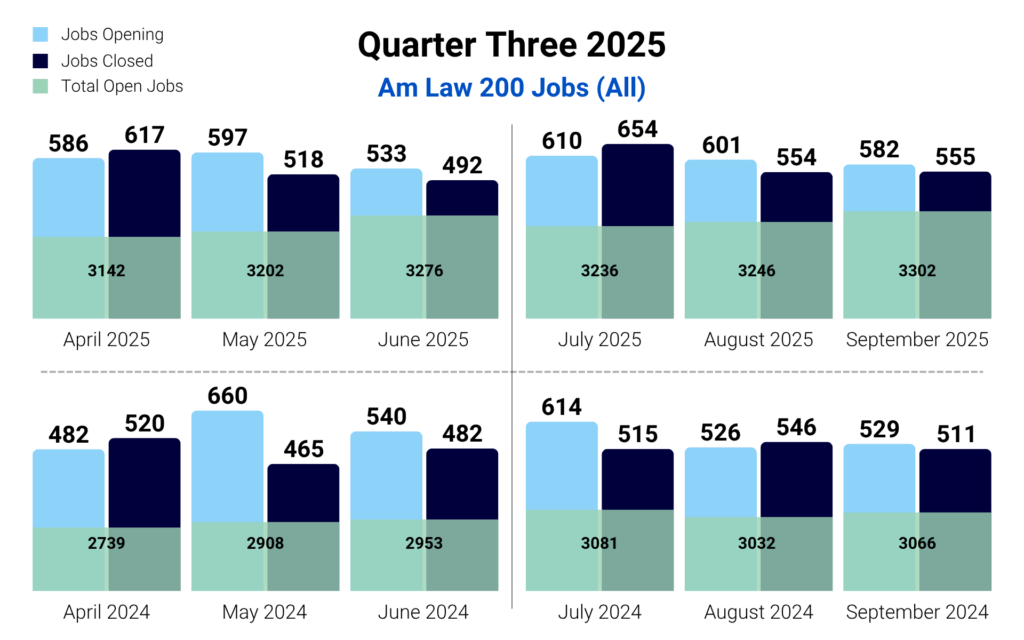

Am Law 200 Firms: Strategic Moves for Top Talent

The Am Law 200 job market maintained steady hiring in Q3 2025, continuing to show strength despite broader market caution. Firms posted 1,793 new openings and 1,763 closures, with 3,302 total open roles—up 7%, 12%, and 8% from Q3 2024.

The near balance between openings and closures suggests active lateral movement, emphasizing experienced attorneys. Firms continue to recruit strategically, focusing on high-demand areas like corporate, real estate, and intellectual property.

Notably, September 2025 alone saw a 10% year-over-year growth in new postings, highlighting a competitive market for top talent.

Quarter-over-quarter, growth was modest from Q2 2025 (+77 openings, +136 closures), indicating a steady, disciplined hiring pace, rather than a hiring surge.

Compared to:

- Q3 2024: 1,669 new job openings | 1,572 jobs closed

- Q2 2025: 1,716 new job openings | 1,627 jobs closed

Bottom Line & Looking Ahead

Q3 2025 reflects a legal job market defined by balance and selective growth. Across all firm types, from the broader market to U.S.-based firms and the Am Law 200, openings and closures are closely aligned, showing firms are filling critical roles efficiently while maintaining overall stability.

Rather than chasing rapid growth, firms are adopting a measured and purpose-driven hiring strategy as they prepare for year-end and look ahead to 2026. According to data from the Lateral Trend Report within SurePoint Legal Insights’ Business Intelligence suite, Am Law 200 firms are focusing on lateral moves and the recruitment of experienced attorneys, with activity already surpassing 2024 totals.

Firm mergers are also shaping headcount, with 47 law firm combinations through Q3, up from 43 in 2024, reinforcing a market in motion but carefully managed.

Methodology Note:

This report is based on a consistent cohort of 1,100+ firms tracked since the beginning of the reporting period to ensure trends reflect true market shifts rather than database growth.

For more insights into legal job trends, hiring activity, or lateral hiring patterns, contact us or learn more here.