McDermott Will & Emery and Schulte Roth & Zabel have officially approved their merger, which is set to be finalized on August 1. The deal will create a legal powerhouse with more than 1,750 attorneys and $2.6 billion in combined revenue, firmly positioning the combined entity among the top 20 U.S. law firms by both headcount and revenue.

While the deal began informally through personal partner ties, it has rapidly evolved into a potentially transformative alignment, particularly strengthening the firms’ shared foothold in New York, where the new entity would stand out as one of the city’s largest private legal operations.

Complementary Strengths Drive Strategic Alignment

Using SurePoint’s proprietary Business Intelligence Merger and Acquisition tool powered by Leopard Solutions, we explore what this union could look like in practice—blending McDermott’s national clout in healthcare, tax, and M&A with Schulte’s deep bench in private capital, financial services regulation, and private equity. As firms across the legal sector pursue consolidation to scale up profitability and expand market reach, this merger offers a compelling case study in strategic complementarity, cultural alignment, and market recalibration.

Looking Ahead: A Calculated Bet on Scale and Synergy

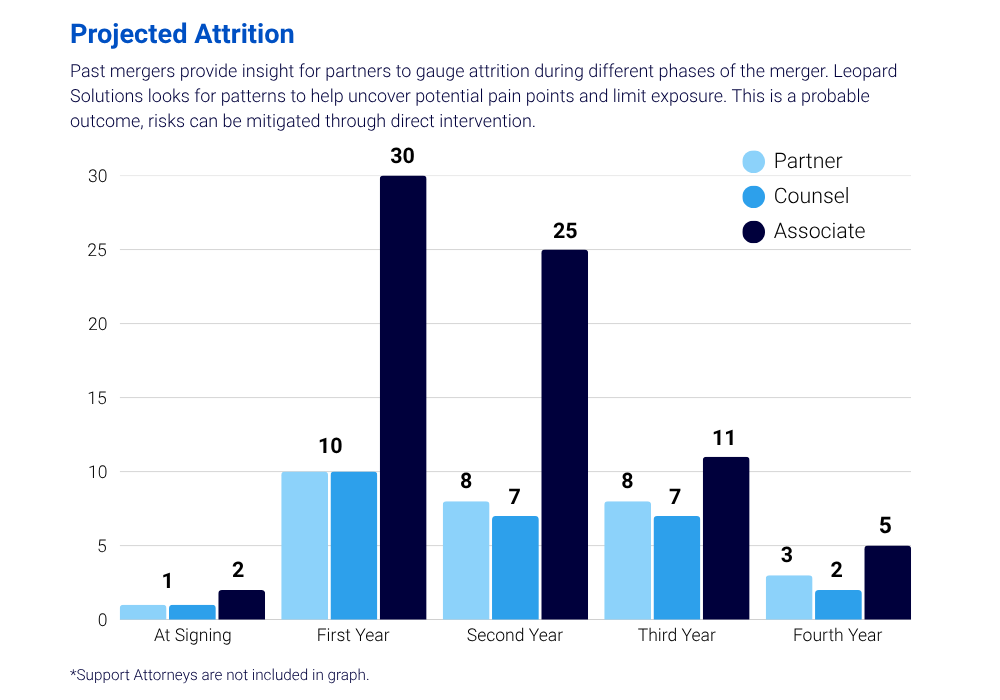

As with any transformative law firm merger, long-term success will depend not only on the strategic alignment of practice areas but also on the firms’ ability to retain top talent and harmonize disparate cultures.

According to Leopard Solutions’ AI-powered projection model, the McDermott-Schulte combination has a projected retention success rate of 68%—a relatively strong outlook when benchmarked against similar mergers in recent years. For comparison, Holland & Knight’s acquisitions of Waller Lansden and Thompson & Knight achieved retention rates of 71% and 68%, respectively. Other high-profile combinations, such as Troutman Pepper and Clyde & Co., posted more modest outcomes, at 48% and 50%, respectively.

Still, even with a promising retention rate, the firms are projected to experience a 27% decline in headcount. This figure suggests underlying challenges in cultural integration, compensation alignment, or practice redundancy.

What the Combined Firm Will Look Like

The newly combined firm would include 1,758 attorneys, with a distribution of 801 partners (46%), 206 counsel (12%), and 755 associates (43%). Schulte’s recent attrition pattern—74 exits and 72 hires in the past year—suggests a relatively stable, though somewhat fluid, talent environment that could be disrupted further during the integration process.

Compensation and career progression structures also reveal key contrasts. McDermott’s average partner compensation stands at $1.9 million, while Schulte’s partners average $2.6 million, a significant spread that may require recalibration to avoid internal friction. Promotion timelines are similarly misaligned: new associates at McDermott reach promotion in an average of 2,580 days, compared to a much longer 5,308 days at Schulte. For lateral hires, the gap is narrower but still notable—1,256 days at McDermott versus 1,862 days at Schulte.

On the growth side, the merger will dramatically enhance the firm’s presence in key markets. The New York office is expected to grow by 330 attorneys, while London and Washington, D.C., are expected to see net increases of 26 and 21, respectively. In terms of practice capabilities, the firm’s largest expansions will occur in corporate (+160 attorneys), litigation (+77), banking (+41), and tax (+29)—creating a more robust, cross-functional platform for servicing both institutional and private capital clients.

Financial Outlook

Financially, the merged entity will rank among the elite. With combined gross revenues nearing $2.8 billion and revenue per lawyer averaging around $1.7 million, the firm would place solidly in the top 20 U.S. law firms by earnings and headcount. Notably, the merger does not add new geographic locations but instead deepens the firms’ existing footprint—underscoring a strategic emphasis on scale and efficiency over expansion for its own sake.

Ultimately, the McDermott-Schulte merger presents a compelling blueprint for what modern legal consolidation can achieve when driven by complementary strengths, shared ambitions, and data-informed forecasting.

Success is far from guaranteed, but with thoughtful integration planning and proactive talent management, this deal could redefine the landscape for elite law firms navigating the next decade of legal practice.

For firm-specific merger metrics or custom comparisons by region, practice area, or growth stage, explore our suite of legal tools.